Anticipated Personal Living Changes: risk of job loss, illness, and major life changes like having a child or taking a career break to obtain further education.If your numbers sound off they may ask to see recent bank statements to authenticate them. Beyond the headline numbers, some lenders may lower your total limit for each additional child in the family. Outgoing Expenses: debt service fees on credit cards and other loans, insurance policies, council tax, vehicle expenses, utilities, and other basic living costs like recreation and childcare.Self-employed people need to show additional documentation including their bank statements, business accounts, as well as their recent income tax payments.

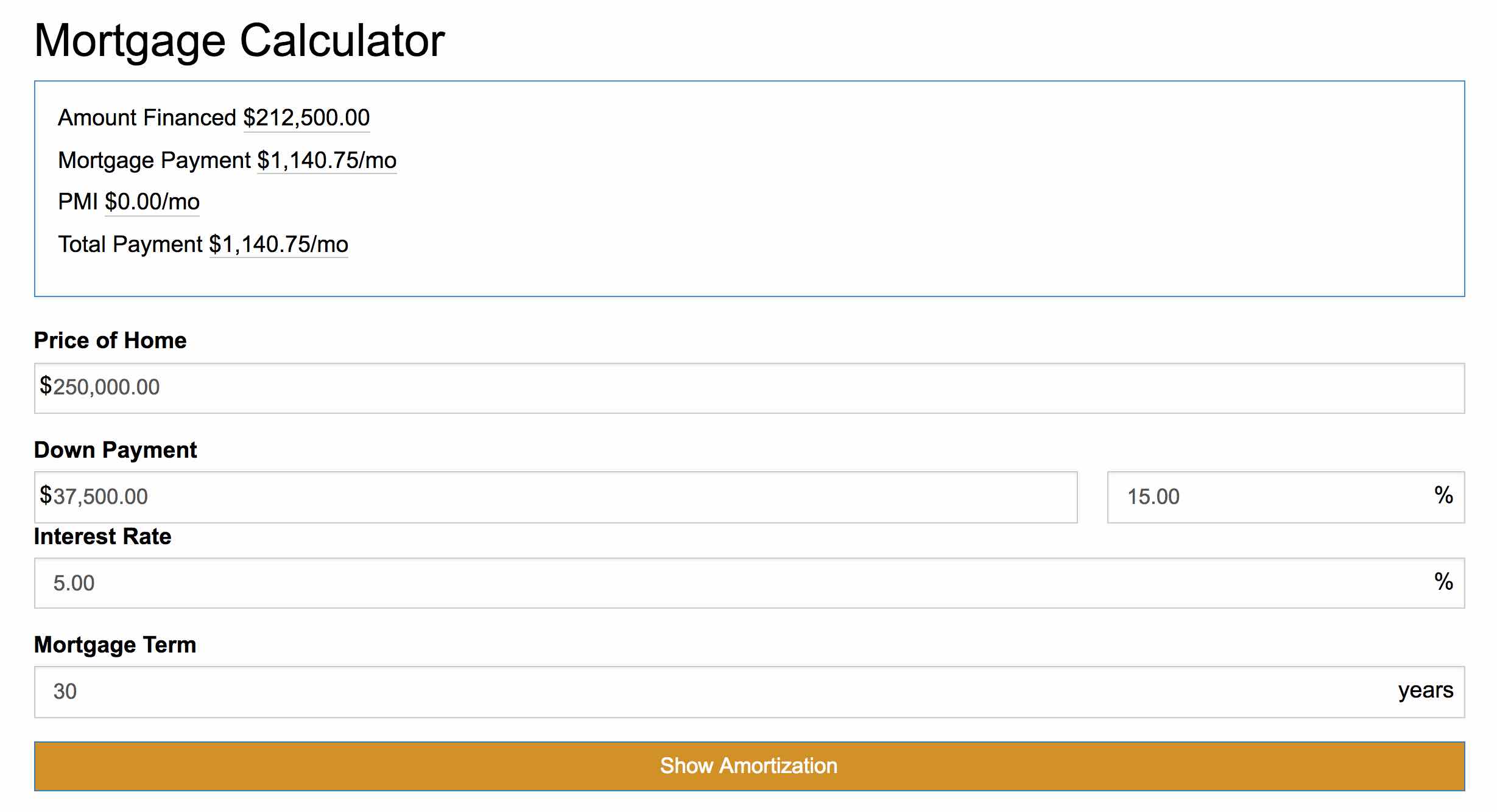

MORTGAGE CALCULATOR PAYMENT FULL

Some lenders may count overtime income in full while others may count it at a reduced rate of 50%. Pretax Income: basic income, pension, finacial support from ex-spouses & any other earnings like overtime, sales commissions or workplace bonuses.So if you deposit 25% on a home that would mean the LTV is 75%. Typically LTV is the percent of the home's value not covered by your downpayment. Loan-to-value: Lenders specify different limits for how much they are willing to loan for each type of loan product on offer.

In addition to your income level, lenders consider recent financial troubles, missed payments, and general living expenses when they determine suitability and lending limits. In our above calculation for individuals we subtract £3 for each £1 of debt for individuals and £2.4 for each £1 of debt for couples with multiple income providers. Lenders presume borrowers spend about 3% to 5% of their outstanding debts on servicing costs. How Much Can I Borrow? Detailed Considerations In June of 2022 the Bank of England pressed ahead with plans to scrap this mortgage affordability test, though borrowers who are stretched should consider what happens to their finances if rates rise.

In the wake of the 2008 - 2009 financial crisis the Bank of England implemented mortgage affordability testing rules which aimed to stop banks from offering risky loans where the borrower would be unable to repay the reversion rate on the loan if the rate increased by 3%. The reason why limits are lower for joint incomes is it is more likely someone will either get laid off or want to voluntarily quit to start a family or go back to school.

0 kommentar(er)

0 kommentar(er)